Philip Fisher’s scuttlebutt method

For a man like Berkshire Hathaway chairman Warren Buffett who doesn’t personally own an iPhone, one wonders why he more than doubled Berkshire Hathaway’s holdings in Apple to about 2.5 per cent in January 2017. At that point, Mr Buffett owned US$17 billion worth of the tech giant’s stock

In a CNBC report on 27 February 2017 titled “Billionaire Warren Buffett more than doubled his holdings in Apple in 2017”, Mr Buffett, when asked why he raised the stake in Apple, was quoted as saying “because I liked it”. The legendary investor cited Apple’s consumer-retaining power and CEO Tim Cook’s smart capital deployment strategy.

“Apple strikes me as having quite a sticky product, and an enormously useful product to people that use it,” Buffett said.

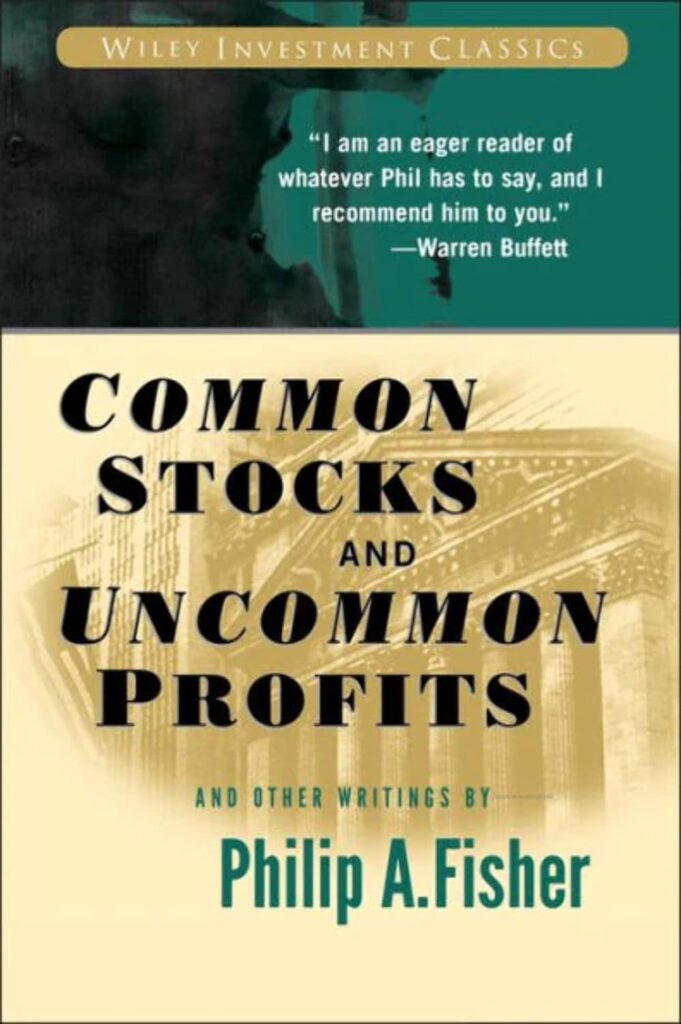

What was interesting is that Mr Buffett went on to say that the late investor Philip Fisher’s 1958 book “Common Stocks and Uncommon Profits” had inspired him to research how consumers felt about Apple products. Mr Fisher talked about something called the “scuttlebutt method“, Mr Buffett said, adding that this method “made a big impression on me at the time, and I used it a lot”.

The “scuttlebutt method”, said Mr Buffett, is essentially going out and finding out as much as you can about how people feel about the products that they use.

Let’s look further into who Philip Fisher was and what his “scuttlebutt method” was all about.

American stock investor Philip Arthur Fisher (September 8, 1907 – March 11, 2004) was best known as the author of the investment guide book known as Common Stocks and Uncommon Profits. The book has the reputation of staying in print since it first published in 1958.

Phillip Fisher was referred to by Mr Buffett as “a respected investor and author” in a letter to Berkshire Hathaway shareholders. Among his best-known followers is Mr Buffett who reportedly has said on some occasions that “he is 85% (Benjamin) Graham and 15% (Philip) Fisher”. Benjamin Graham (May 8, 1894 – September 21, 1976) is the father of value investing and Mr Buffett is his best known student.

Back to the “scuttlebutt method”, which provides clues that are needed to find really outstanding investments. Philip Fished said he called it “scuttlebutt method” for lack of a better term.

“The business ‘grapevine’ is a remarkable thing,” said Philip Fisher. “It is amazing what an accurate picture of the relative points of strength and weakness of each company in an industry can be obtained from a representative cross-section of the opinions of those who in one way or another are concerned with any particular company.”

“Most people, particularly if they feel sure there is no danger of their being quoted, like to talk about the field of work in which they are engaged and will talk rather freely about their competitors. Go to five companies in an industry, ask each of them intelligent questions about the points of strength and weakness of the other four, and nine times out of ten a surprisingly detailed and accurate picture of all five will emerge,” said Mr Fisher.

According to Philip Fisher, competitors are only one and not necessarily the best source of informed opinion. Much also can be learned from both vendors and customers about the real nature of the people with whom they deal. Research scientists in universities, in government and in competitive companies are another fertile source of worthwhile data. So are executives of trade associations, according to Philip Fisher.

“The next step is to contact the officers of the company to try and fill out some of the gaps still existing in the investor’s picture of the situation being studied,” said Mr Fisher.